The fine wine world is changing, as it progressively modernises, and it plays catch-up with other sectors that have successfully migrated online and found ways to reach a bigger market through a variety of marketing and sales channels.

2020-2022 proved to be a defining period for the industry, worldwide, as one of the few sectors that stayed open for businesses during Covid and, in most cases, business boomed. With spending on hospitality switching to home consumption, the convenience and potential scale of online became obvious. As did the overhead of running e-commerce divorced from live stock positions, or indeed selling online off stock positions that were intrinsically unreliable due to legacy management issues.

Technology counts for nothing without customer service, or, perhaps a better way of thinking about it is that a consistently high level of service needs anchoring with tech?

As a wine tech platform for wine merchants and retailers (Wine Hub), we already had a strong sense of the relationship between a positive customer experience and software from the wine trade’s perspective.

Will di Nunzio, CEO of Italy specialist DVNO, has been in the wine business for 14 years, first in New York running a 30-strong team, and latterly out of California. For him, customer service is #1.

“You need the tech so that everyone knows where everything is, what’s available, what’s deliverable, and so that people can communicate effectively. It’s essential if you want to grow and also (when it’s your own business) have the prospect of a bit more personal freedom. It wouldn’t have worked if everything had to channel through me.”

“Having a platform that manages the core business functions makes our job a lot easier. Customer service is not an easy job, and to do the job well you need the right tools. Having a platform like Wine Hub, which is simple and easy to use, is very important. It saves you time.”

But we really wanted to find out how satisfied private wine buyers are. What kind of service they are experiencing, and whether their attitudes have changed as a result of shifting consumer behaviour.

This was the fine wine consumers’ moment to tell us what matters most to them; what influences their buying decisions and how that might have changed over the last few years; to tell us about their experience as a customer of wine, and perhaps, in some small way to positively influence the future direction of the fine wine business.

Research

We formed a research panel from private clients who had signed up to the Wine Owners collection management platform over the past few years, the parity of answers supporting a representative set of perspectives of the fine wine buying market. 75% of respondents were aged 50+, with the rest in the 35-49 age bracket.

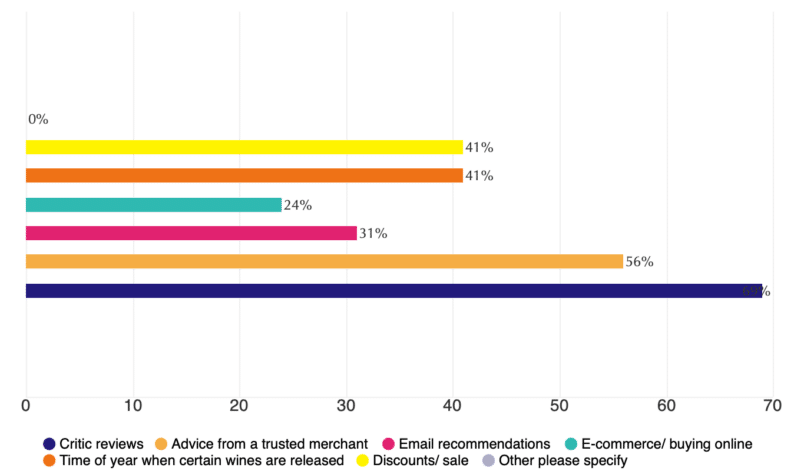

Most fine wine consumers buy from multiple merchants, 45% buy from 6 or more, and three quarters buy from 4 or more. That makes for a hyper-competitive market, facilitated by Wine-Searcher, especially when you consider that 76% citing best price as a key criteria, with 42% saying that it was the most significant aspect.

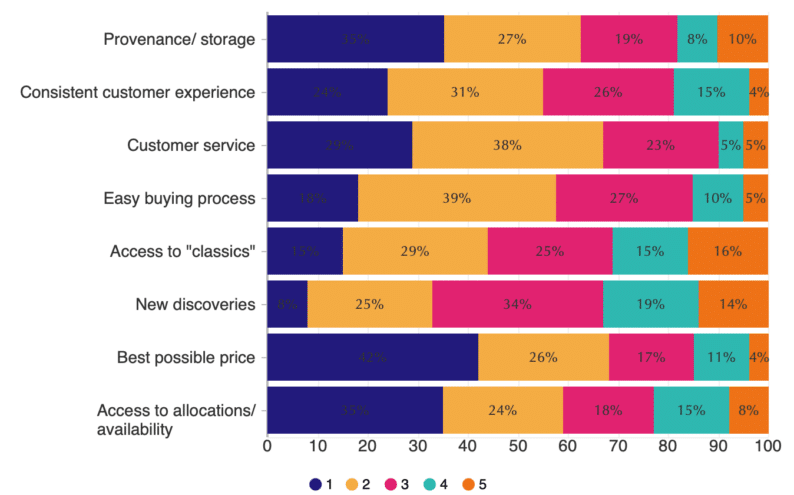

There are other important aspects cited, such as access to allocations, provenance and storage (the tied second most important buying criteria), followed by customer service and an easy buying process. But free text comments we received suggest that customer service is a base expectation.

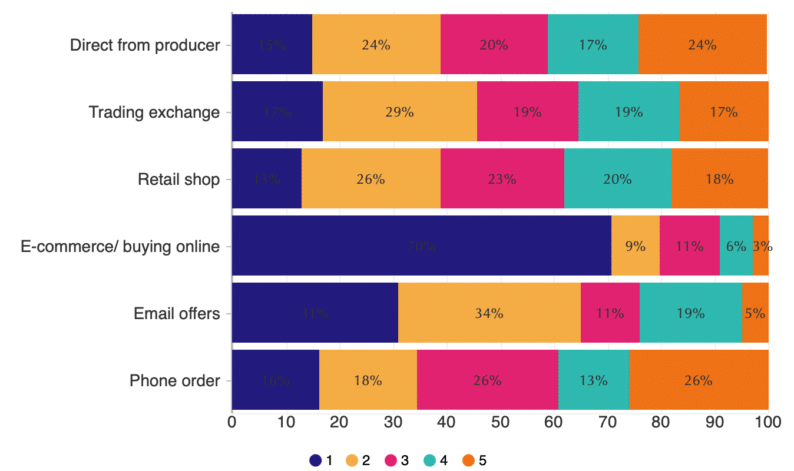

We asked our panel which buying channels are the most significant to them, and whether these have changed recently. Whilst 45% of respondents cited no change, the majority have shifted away from shops, phone orders and direct from producer (cellar door), in favour of online (the number one preference for 61% of respondents) and email.

The challenge for wine merchants is figuring out who these new online buyers are and connecting with them. As Matt di Nunzio says, “e-commerce is more difficult, customers take a chance not knowing who you are, you get the order, you need to reach out, you need to understand what the story is behind their purchase.”

Private clients want that outreach, according to Eric Sabourin at Falcon. “Since going live with e-commerce, we’ve been picking up new clients every day; a number of whom have since spent tens of thousands of pounds with us offline as we got to know them”.

A proportion of existing clients will ‘jump channels’ if given the choice of an easy to use e-commerce website, according to Tom Mann. “I have to say it’s striking how many offline clients are purchasing online as well.”

Underpinning how private clients vet merchants and build confidence over the longer term is advice-giving; still the most valued input next to critics’ reviews. Granted there are online recommendation engines such as Preferabli that help personalise the search and selection experience, underpinned with heaps of data and AI, but it’s early days and meantime personal service delivered through knowledgeable account managers is significantly valued by private clients and collectors..

Customer satisfaction

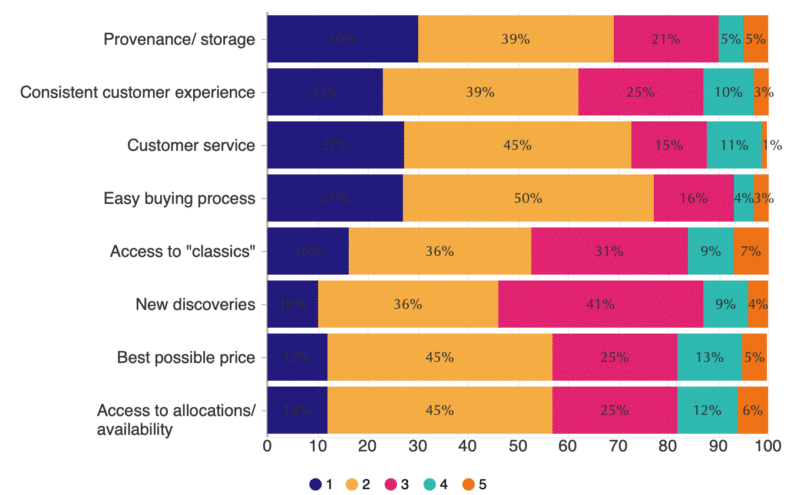

Next we explored how well wine merchants are delivering on the pre-purchase measures that matter most to buyers. In this section questions were presented in two parts – firstly, what’s most important to you and secondly, how your sources of supply are doing against those aspects.

Pre purchase

The first question relates to the merchant offering and aspects to do with the buying process.

The vast majority of respondents were satisfied or very satisfied with the ease of buying and related customer service, with the service levels well aligned with their personal priorities.

It was noticeable that the percentage satisfied dropped when rating consistency of customer service, with well over a third being less impressed. Yet overall fine wine merchants are delivering a buying proposition that is meeting the needs of private clients on service.

Of course, private clients want better allocations and pricing; with release prices rising fast and supply volumes down, it’s hardly surprising. It certainly hasn’t stopped the fine wine market from performing exceptionally well over the last two and a half years.

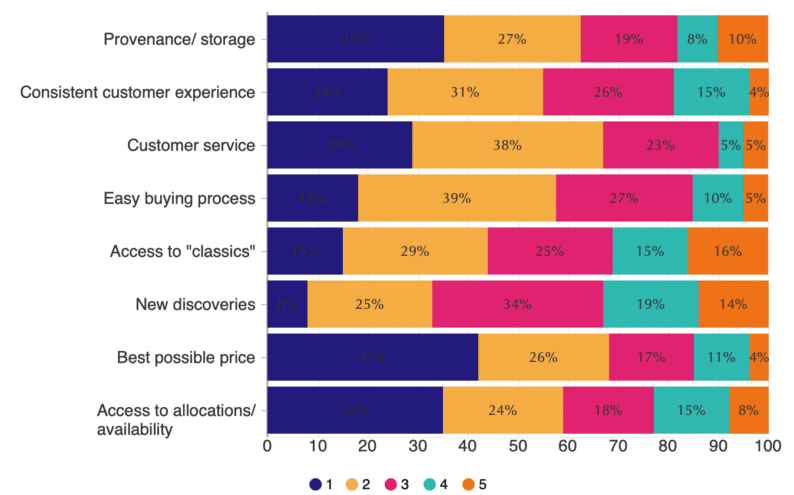

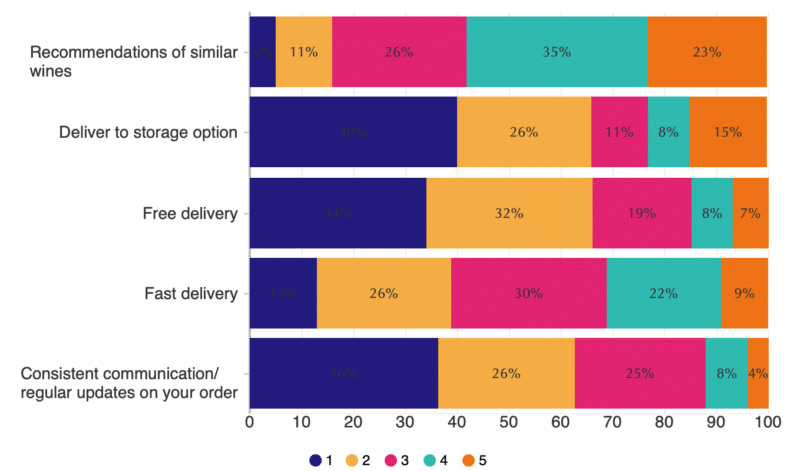

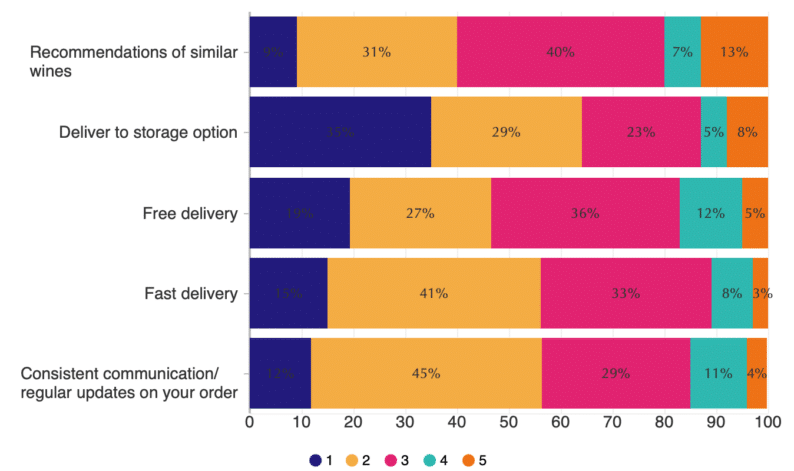

Post purchase

So what about after the purchase has been made? This is where workflow management and tracking of orders can really make a difference to the consistency of service delivered to private clients. First, here are the post-purchase service elements that matter most to fine wine buyers.

When it comes to measuring the performance of wine merchants against these ranked measures, all is good apart from the question of consistent communication and regular updates on your order. Whilst just over a third of respondents see that is the #1 priority, only 12% are very satisfied in practice, and one third are less than satisfied or dissatisfied.

Prospects for customer success

There’s been a significant shift to buying online in recent years, with 79% of people surveyed buying through e-commerce (and note that the demographic of respondents was significantly within the 50-75 age bracket ). 40% of respondents have shifted at least a proportion of their wine purchasing online with 61% citing e-commerce as their primary buying channel.

Investment in e-commerce by wine merchants has followed, but the wine trade as a whole is lagging behind the consumer trend. Partly that’s due to concerns around the overhead of managing e-commerce alongside existing off-line and email-driven business, cost, and worry lines of guaranteed live online inventory.

Client satisfaction is generally good, especially around the time of sale, whereas there are improvements to be made in terms of consistency of customer service and follow up communications.

Firstly there is too often a disconnect between customer management and the follow-through provided by back office staff, as exemplified by the following quote.

“My primary wine-buying relationship is with two merchants, and I liaise with my respective, assigned Private Client Managers. Service from those individuals is very good but I don’t get the impression their back office/admin teams are up to scratch”.

The reality is that back office team members are only as good as the business management platform that enables them to deliver a consistently good customer experience. It’s unfair to pin the blame on individuals or training, which is commonly exemplary. The ongoing service they’re able to provide can only be as good as tracking systems and task management, as mentioned above. It’s what makes it possible to consistently manage the more complex and elongated process steps so typical within fine wine, and that’s what determines the efficiency of operations that enables a business to scale during periods of peak demand.

Here’s what another respondent had to say about the dynamic between relationship management and technology. “The best merchant experiences are less superficially tech-based relationships. The worst are due to high demand and when the computer says “no” from someone in a customer service centre”.

In other words, advice-giving based on a solid understanding of a client, associated recommendations and allocation of wines remains fundamental to the success of a fine wine merchant, but that’s all too easily undermined by inflexible systems that make team members appear inflexible too.

The following quote from a survey respondent speaks to those elongated steps associated with en primeur orders that get sold during late spring and summer of one year and get delivered a couple of years’ later.

“I have bought a lot of wine en primeur and I have lost count of the number of merchants who have not performed and needed to be chased to deliver an order or have repeatedly attempted to charge for storage when the wine hasn’t been delivered – it can take months to resolve it.”

We often hear directly from wine merchants about how poor software can hold back the business. It was interesting to observe how transparent that is to their clients, and the negative impact that has on loyalty and word of mouth.

“My long-standing wine merchant hasn’t kept up with the digital world and their customer website is ancient and virtually unusable.”

”This lack of service will only result in me moving more business to smaller and keener merchants.”

The good news is that there’s been a significant wave of investment committed over the last two years, which is raising the minimum level at which businesses need to operate in order to effectively compete. If that results in the rest of the wine trade taking a hard look at how they need to overhaul their business to grow private client spend, that will be to the long-term benefit of fine wine buyers everywhere.